from Prof. Dr. Thomas Ankenbrand, Denis Bieri, Timon Kronenberger und Levin Reichmuth

Despite (or perhaps because of) high volatility, temporarily increasing return correlation with other asset classes, hypes and crashes, the Swiss and Liechtenstein ecosystem for crypto assets remains active. This is the conclusion of the “Crypto Assets Study 2022” by the Lucerne University of Applied Sciences and Arts, which for the second time provides an overview of the various business models in the ecosystem as well as a breakdown of the aggregated volumes in the crypto market (download the study directly). In the following, we go into selected results of the study.

New products come on the market

The Swiss investment ecosystem for cryptoassets investments offers more and more financial products. In the field of indirect investments, this can be seen, among other things, in the number of ETPs domiciled, traded or for sale in Switzerland and/or Liechtenstein. Not only is the number of products increasing, but also their diversity (see Figure 1). In addition to the introduction of new product types, this is also reflected in the increasing breadth of underlying assets. As the ecosystem evolves, further innovations can be expected, not only in the area of indirect investments, but also in direct investments, driven for example by developments in the area of Decentralized Finance (DeFi).

Figure 1: Number of crypto-related indirect financial products traded in Switzerland by product type (left chart) and underlying (right chart) (Sources: BX Swiss, SIX).

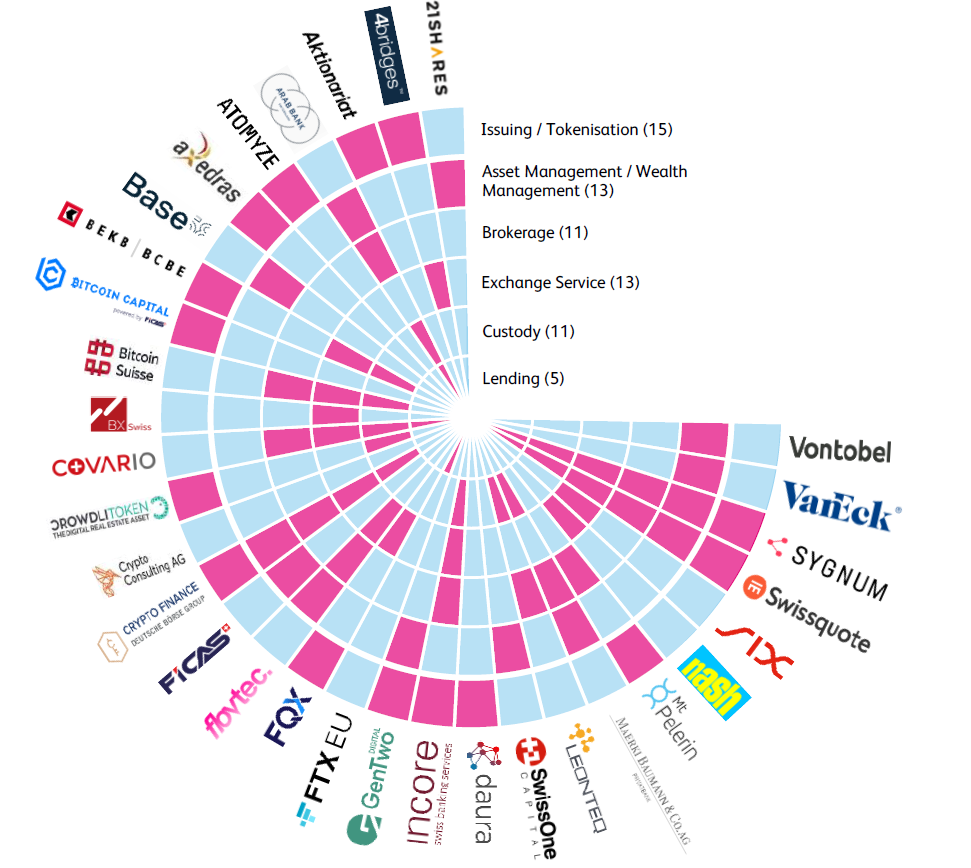

Broad range of products and services, but not for all customer segments

The ecosystem offers both direct and indirect investment solutions in crypto assets as well as infrastructure services. In this context, the majority of the surveyed companies[1] target corporate and/or institutional customers rather than retail customers. Issuance and tokenization solutions as well as exchange services are the most frequently mentioned offerings. Services in the area of “lending”, on the other hand, are offered by comparatively few companies (see Figure 2). The evaluation also shows that there are specialists in the ecosystem who only offer individual services of the entire crypto asset investment value chain, but also a few generalists with a broader offering across the entire investment value chain.

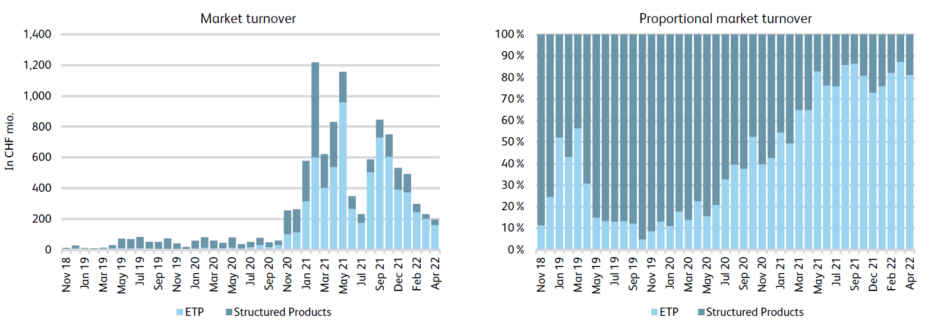

Trading volumes on centralized crypto exchanges are still the largest

Crypto assets or corresponding derivatives can be traded on traditional exchanges as well as on centralized or decentralized crypto exchanges. The largest trading volume is conducted on centralized crypto exchanges. Specifically, the annual trading volume originating from Switzerland on centralized crypto exchanges amounted to an estimated 200 billion Swiss francs during the observation period from May 2021 to April 2022. The trading volume on decentralized crypto exchanges amounts to 5.1 billion Swiss francs in the same observation period, which is smaller than that on the two Swiss exchanges, BX Swiss and SIX Swiss Exchange, which account for 6.5 billion Swiss francs. In terms of traditional exchanges, it can be noted that ETPs account for the largest share of trading volume. However, while the number of crypto-related products is steadily increasing, the volume has been declining for several months (see Figure 3). More specifically: While the monthly trading volume of crypto-related financial products on the two exchanges BX Swiss and SIX Swiss Exchange was still 1.2 billion Swiss francs in February 2021, it was 196 million Swiss francs in April 2022, i.e. more than six times lower.

Figure 3: Trading volumes on the BX Swiss and SIX Swiss exchanges (sources: Bloomberg, BX Swiss, SIX)

High risks, but also potentially high gains

Analysis shows that even simple investment strategies in crypto assets may have been beneficial to investors in the past, delivering higher risk-adjusted performance in a portfolio context. However, this comes with increased risk, as standard risk measures such as standard deviation or maximum drawdown of a portfolio containing crypto assets show. Furthermore, during periods of high volatility, the return correlation with traditional assets can be high, temporarily reducing the diversification potential of crypto assets.

Download the study here (available in English only).

[1] Between May and June 2022, a total of 133 companies in the Swiss and Liechtenstein crypto asset ecosystem were contacted, of which 32 participated in a standardized survey.

Comments (0)